sales tax in fulton county ga 2019

Atlanta GA Sales Tax Rate The current total local sales tax rate in Atlanta GA is 8900. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis.

Fulton County Georgia New Energy And A New Mission Aim To Complete The Picture In Greater Metro Atlanta Site Selection Online

The minimum combined 2020 sales tax rate for Fulton County Georgia is 89.

. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. As for zip codes there are around 75 of them. I didnt see any data on the SF sales tax revenue.

The Fulton County sales tax rate is 3. Georgia Department of Revenue Sales Tax Commodity Report Other Tax Collection Revenue. Helpful Links Cities of Fulton County.

Water and Sewer Expenditures July YTD 2019. This is the total of state and county sales tax rates. If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate is 49.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. 837 Average Sales Tax For Fulton County Georgia Summary Fulton County is located in Georgia and contains around 7 cities towns and other locations. 30301 30302 30303.

Fultons rate inside Atlanta is 3. Actual Salary and Benefits. Taxpayer Refund Request Form.

Refund requests must be made within one 1 year or in the case of taxes three 3 years after the date of the payment of the tax or license fee Refer to OCGA. The sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government division. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166.

The 2018 United States Supreme Court decision in South Dakota v. The Fulton County sales tax rate is. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

Has impacted many state nexus laws and. The proposed short-term plan update includes 16 B in rapid transit projects across Fulton County based on the passage of HB 930 which allows for a 02-cent sales tax over 30 years 100 M in State funding allocated to GA 400 and an assumed 200 M in Federal. Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov.

060 Fulton Not Atlanta 775 ML E Tf 060A Fulton In Atlanta 89 ML E O mTa 061 Gilmer 7 L E S 062 Glascock 8 L E. Tax Sales The Fulton County Sheriffs Office month of November 2019 tax sales. For TDDTTY or Georgia Relay Access.

This coupled with the base rate of Georgia sales tax means the effective rate is 89. You can find more tax rates and allowances for Fulton County and Georgia in the 2022 Georgia Tax Tables. A full list of these can be found below.

The December 2020 total local sales tax rate was also 8900. All taxes on the parcel in question must be paid in full prior to making a refund request. Higher sales tax than 99 of Georgia localities -05 lower than the maximum sales tax in GA The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special tax.

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19.

The December 2020 total local sales tax rate was also 7750. The Fulton County Georgia sales tax is 775 consisting of 400Georgia state sales taxand 375Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax. The Georgia state sales tax rate is currently.

Fulton County in Georgia has a tax rate of 775 for 2022 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Fulton County totaling 375. Top 5 Bottom 5 GA Counties by Sales Tax Growth Loss Source. The Fulton County Sales Tax is 26 A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Surplus Real Estate for Sale. This is the total of state and county sales tax rates.

In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The Board of Commissioners and County Manager have categorized County efforts into. Please fully complete this form.

The Georgia state sales tax rate is currently 4. The 1 MOST does not apply to sales of motor vehicles. Fulton County GA Sales Tax Rate The current total local sales tax rate in Fulton County GA is 7750.

The 10 counties account for 1339 of Georgias total sales tax revenue generation in July 2020 Fulton county accounts for 1276. This presentation outlines an update to Fulton Countys Transit Master Plan. Sales Tax Breakdown Atlanta Details Atlanta GA is in Fulton County.

How Does Sales Tax in Fulton County compare to the rest of Georgia. Atlanta is in the following zip codes. Click to see full answer Moreover what.

There will be NO tax Sale for May 2022. GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2019 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

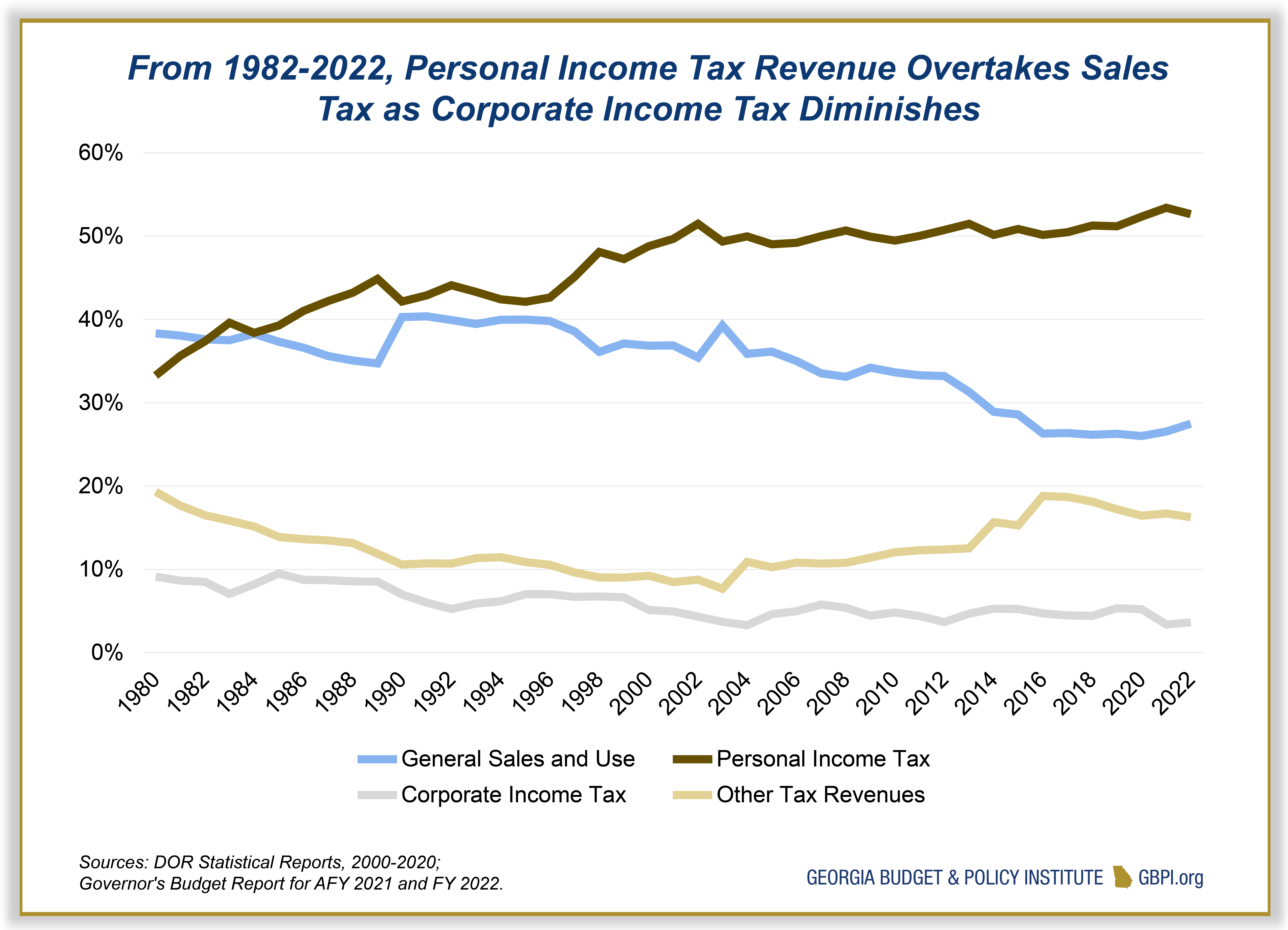

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

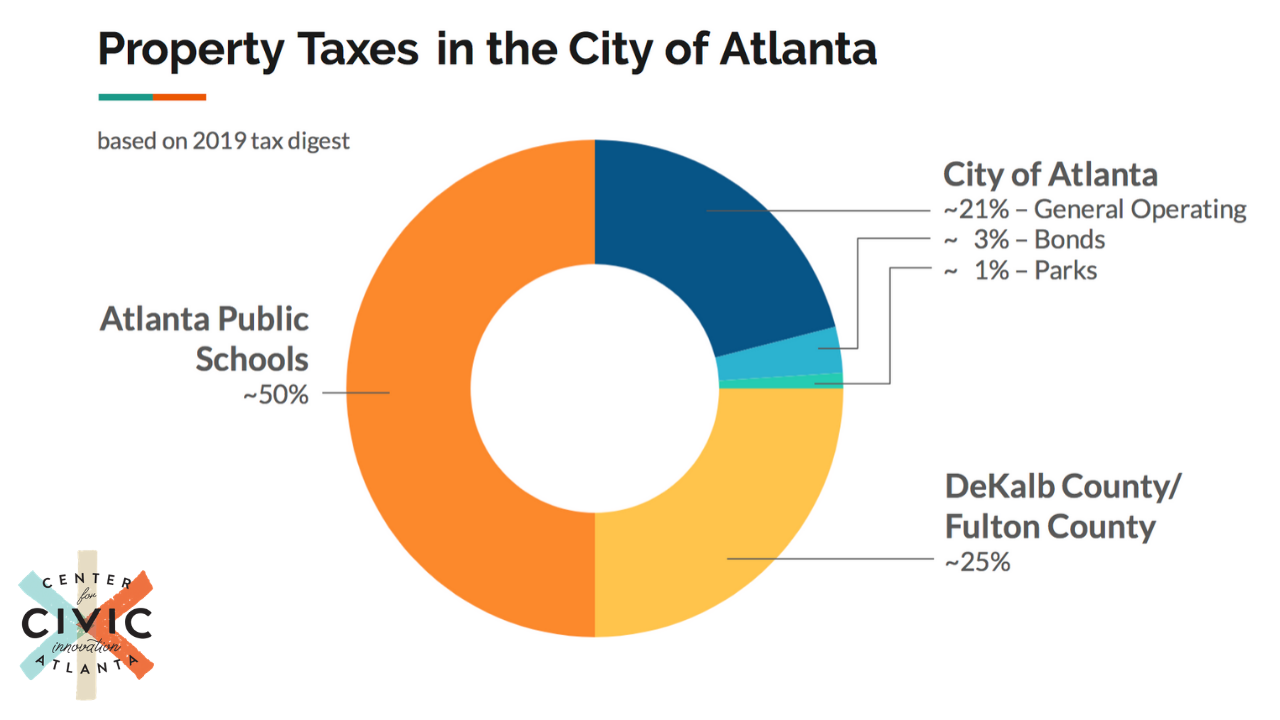

Social Studies Dollars And Sense Understanding Local Budgets Center For Civic Innovation

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Ga Restaurants And Food Businesses For Sale Bizbuysell

Fulton County Ga Property Data Real Estate Comps Statistics Reports

Ga Application For Basic Homestead Exemption Fulton County 2019 2022 Fill And Sign Printable Template Online Us Legal Forms

Sales Taxes In The United States Wikiwand

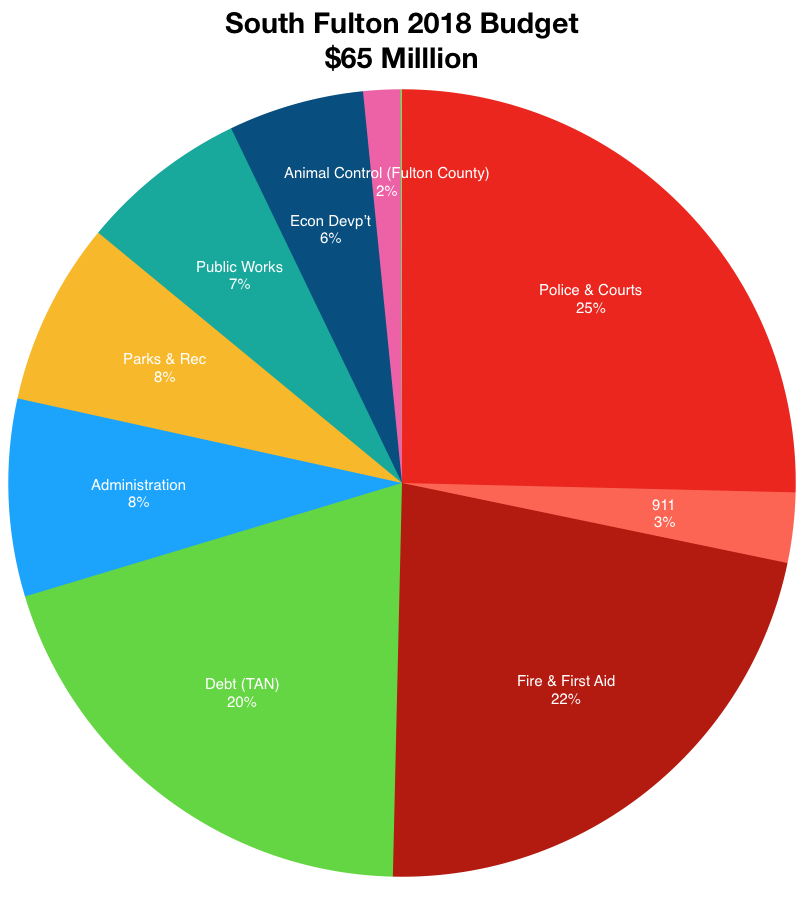

City Of South Fulton Ga Archives

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Fill Free Fillable Forms Fulton County Government

Fulton County Transportation Efforts To Continue Voters Extended Sales Tax Saportareport

Atlanta Property Tax Consultants Ke Andrews Fulton County Appeals

Atlanta Georgia S Sales Tax Rate Is 8 5

How Many Small Businesses Are There In Georgia See The Past 5 Years Of Stats

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute